Watch and listen to conversations with speakers from around the world for free online and explore our library of essays. Sign up to our newsletter to stay up to date.

Attend

-

Sparks Bristol

-

Waterstones | £6 – £8

-

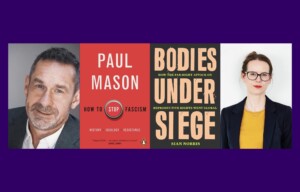

Festival of Ideas

St George’s Bristol | £10

Listen

-

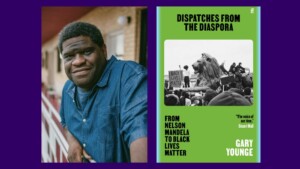

Festival of Ideas

-

Festival of Ideas

-

Festival of Ideas